How Retail Investors Can Invest in Crypto Startups

The world of crypto is evolving at lightning speed. Where early-stage investments in blockchain companies used to be reserved for venture capital firms and professional investors, retail investors today have more access than ever. Crypto startups often deliver innovative solutions and, if successful, can generate significant returns. But how does investing in these startups actually work, and what should you be aware of?

What Are Crypto Startups?

A crypto startup is a young company developing products or services in the blockchain and Web3 space. Examples include DeFi platforms that enable borrowing and lending without banks, NFT marketplaces, or new layer-2 blockchains designed to make transactions faster and cheaper.

Many of these startups fund their growth by issuing their own token. For investors, this creates an opportunity to get in early and benefit from the project’s potential growth.

How Can Retail Investors Access Crypto Startups?

1. Crypto Launchpads

Popular launchpads like Seedify and ChainGPT host token sales (IDO/ICO events) for new projects. These platforms allow investors to participate in early-stage token sales before they hit major exchanges.

How Does a Launchpad Work?

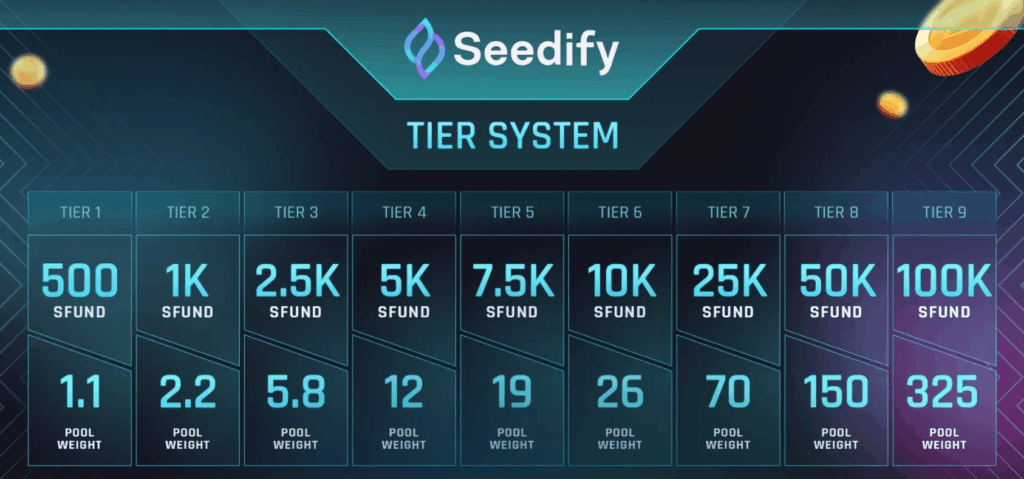

Most launchpads operate on a tier-based system. To qualify, you usually need to purchase and stake the launchpad’s native token.

The more tokens you hold and stake, the higher your tier.

Higher tiers often guarantee a larger allocation of the new project’s tokens.

Lower tiers may only offer lottery-based participation.

Example: On Seedify, staking a small amount of $SFUND might place you in an entry-level tier with limited lottery chances. Staking 1,000 $SFUND or more may move you to a guaranteed allocation tier, ensuring access to every sale.

This system rewards loyal users but requires an additional upfront investment in the launchpad’s token. That means you must evaluate not only the startup you want to invest in but also the launchpad itself.

2. Community Pools

Platforms like Gains Associates and DaoMaker bring investors together in community pools. By pooling capital, retail investors gain access to private rounds typically reserved for large-scale investors.

3. Exchanges

Once a token is listed on an exchange, anyone can buy it. While prices are usually higher than in the private rounds or IDOs, investors may face less risk since more information is available at this stage.

What to Look Out For

Investing in crypto startups is exciting but comes with risks. Key factors to consider include:

The Team – Who is behind the project, and do they have relevant experience?

Tokenomics – How are the tokens distributed, and what is the vesting schedule?

Roadmap & Community – Is there a clear vision and an active user base supporting the project?

Risks and Opportunities

The potential upside of crypto startups is huge, but many projects fail to deliver or disappear altogether. Diversification is essential, as is only investing money you can afford to lose. For long-term investors, even small allocations in successful projects can have a big impact on a portfolio.

Token Vesting and Staying Organized

One of the biggest challenges of early-stage crypto investing is tracking token vesting schedules. Tokens are often released in stages, meaning you need to know exactly when your tokens unlock. Combine this with fluctuating prices and multiple wallets, and it becomes complex very quickly.

With tools like Vc-Flow, you can easily track all your investments, manage vesting schedules, and see your portfolio at a glance. This gives you clarity and helps you make smarter decisions.

Conclusion

Retail investors today have more opportunities than ever to participate in crypto startups. Launchpads, community pools, and exchanges provide access, but each requires research, strategy, and preparation.

👉 Want to stay on top of your crypto startup investments? Try Vc-Flow for free and discover how easy it is to keep track of your portfolio.

VC-Flow provides tools for tracking and organizing your crypto investments. It does not provide financial advice. Always do your own research before investing in any project or token.

VC-Flow Team

Author